Truist Bank Statements PDF: A Comprehensive Guide (Updated 12/10/2025)

Today’s date is 12/10/2025 09:28:15. Truist offers statements in various formats like BAI2, MT940, CSV, PDF, EDI, and CAMT, providing flexibility for users.

What are Truist Bank Statements?

Truist Bank statements are official records detailing all financial transactions occurring within a specified period for your Truist account. These statements serve as crucial documentation for personal finance management, tax preparation, and verifying account activity. They provide a comprehensive overview of deposits, withdrawals, checks cleared, fees assessed, and the overall account balance.

Available in multiple formats – including BAI2, MT940, CSV, EDI, CAMT.052, and the widely used PDF – Truist caters to diverse user needs. The PDF format is particularly popular for its accessibility and ease of archiving. Statements include vital information like previous and new balances, alongside a detailed transaction history. Accessing these statements is streamlined through Truist’s online banking platform, offering convenient download options for specific date ranges. Remember, creating your own bank statement is not permissible.

Understanding Available Statement Formats

Truist Bank provides a variety of statement formats to accommodate different banking and accounting software requirements. These include BAI2, commonly used for automated data exchange, and MT940, a standard format for international bank transactions. For broader compatibility, CSV, EDI, and CAMT formats (versions 052 and 053) are also offered, catering to diverse financial systems.

However, the most user-friendly option remains the PDF format, ideal for viewing, printing, and archiving. When utilizing FIN messages, the Truist primary BIC code is BRBTUS33. Be aware that BAI codes may experience changes during the transition process. Selecting the appropriate format depends on your specific needs, with PDF offering simplicity and accessibility for most users.

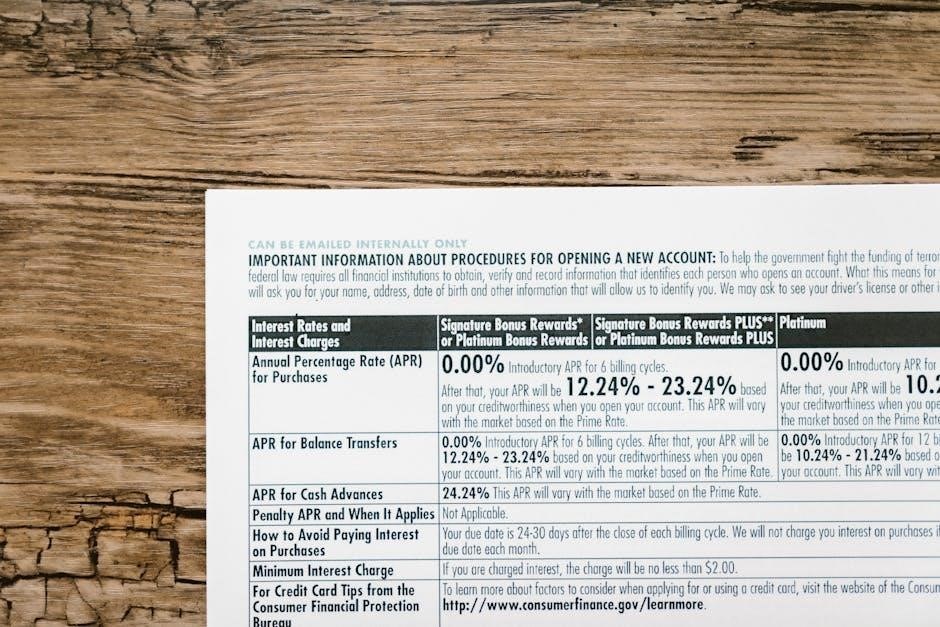

BAI2 Format Details

The BAI2 format is a widely recognized standard for electronic data interchange in the banking industry. It facilitates the automated processing of bank statement information directly into accounting systems, minimizing manual data entry. While highly efficient for automated reconciliation, BAI2 files require specific software capable of interpreting the format’s structure.

During the transition to Truist, users should anticipate potential changes to BAI codes, necessitating updates to their import configurations. It’s crucial to verify compatibility with your accounting software and to consult Truist’s documentation for the latest specifications. Properly configured, BAI2 streamlines financial reporting and enhances data accuracy, though it demands technical expertise for initial setup.

MT940 Format Explained

The MT940 format is another standard used for transmitting bank statements electronically, primarily within the international banking sphere. It’s a message type defined by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network, ensuring secure and standardized data exchange. Like BAI2, MT940 files require specialized software to decode and import the data into accounting systems.

For users receiving FIN messages from Truist, the primary BIC code is BRBTUS33. This code is essential for correct message routing and processing. While robust, MT940 can sometimes present compatibility challenges depending on the specific software used. Ensuring your system supports the latest MT940 standards is vital for seamless statement integration.

CSV, EDI, and CAMT Formats (052 & 053)

Truist provides diverse electronic statement formats beyond BAI2 and MT940, including CSV, EDI, and CAMT. CSV (Comma Separated Values) offers a simple, widely compatible option for importing data into spreadsheets. EDI (Electronic Data Interchange) facilitates automated data exchange between businesses.

CAMT formats, specifically CAMT.052 (current day) and CAMT.053 (prior day), are XML-based standards gaining prominence in Europe and beyond. These formats offer enhanced data structure and reporting capabilities. Choosing the right format depends on your accounting software and integration needs; Customized formats are also available to meet specific partner requirements, ensuring seamless financial data flow.

Accessing Truist Bank Statements Online

Truist makes accessing your bank statements convenient through its online banking platform. Begin by logging into online banking with your credentials. Once logged in, navigate to the Statements section, typically found within the account overview or a dedicated “Documents” area.

From there, you can select and download statements in PDF format. Choose the desired statement number, then click the “Print” option, followed by saving the document as a PDF file. This allows for easy storage and sharing; Remember to regularly check your online banking for the latest statements and ensure secure access to your financial information.

Logging into Online Banking

Accessing your Truist bank statements online begins with a secure login to your account. Navigate to the Truist website and locate the “Sign On” or “Login” section, usually positioned at the top right corner of the page. You’ll be prompted to enter your User ID and Password.

Ensure you are using a secure internet connection and that the website address begins with “https://” to protect your sensitive information. If you’ve forgotten your credentials, utilize the “Forgot User ID” or “Forgot Password” links to initiate the recovery process. Truist employs security measures to verify your identity, potentially including multi-factor authentication for enhanced protection.

Navigating to the Statements Section

Once logged into your Truist online banking account, locate the “Statements” section. This is typically found within the left-hand menu or under an “Account Services” or “Documents” tab. The exact placement may vary slightly depending on updates to the online banking interface.

Clicking on “Statements” will display a list of your accounts. Select the specific account for which you require a statement. You’ll then see a list of available statement periods, usually presented by month and year. From this list, you can choose the statement you need to view or download. The interface is designed for easy navigation, allowing quick access to your banking records.

Selecting and Downloading Statements in PDF Format

After selecting the desired statement period, you’ll typically see a “View” or “Download” option associated with each statement. Choose the option to download the statement. Crucially, ensure you select the .pdf file format when prompted. This ensures the statement opens correctly and maintains its original formatting.

Alternatively, some users find success by first printing the statement (selecting “Print” at the top of the screen) and then, within the print dialogue box, choosing “Save as PDF.” This method provides a reliable way to create a PDF copy of your Truist bank statement directly from your online banking portal, preserving all details accurately.

Truist BIC Code for FIN Messages

For those requiring FIN (Financial Telecommunication Society) messages involving Truist, the primary Bank Identifier Code (BIC) is BRBTUS33. This code is essential for international wire transfers and other financial communications. Utilizing the correct BIC ensures smooth and accurate processing of transactions with Truist Financial Corporation.

Partners and entities engaging in financial exchanges with Truist will receive FIN messages utilizing this standardized identifier. It’s vital to verify this BIC code with your recipient or Truist directly to avoid any potential delays or complications during the transfer process. Accurate BIC usage is paramount for successful international financial operations.

Changes to BAI Codes During Transition

During the transition following the merger of BB&T and SunTrust into Truist, some BAI (Bank Administration Institute) codes experienced modifications. These changes were implemented to align systems and ensure accurate data transmission for statement processing. Businesses and individuals relying on BAI2 format for automated reconciliation should be aware of these updates.

It’s crucial to verify any existing BAI code configurations to reflect the current Truist standards. Failure to do so may result in errors during file processing and reconciliation. Truist recommends contacting their support team or referencing updated documentation to obtain the correct BAI codes for your specific account setup. Proactive verification minimizes disruptions.

Information Included on a Truist Bank Statement

A comprehensive Truist bank statement provides a detailed overview of account activity. Key components include an account summary displaying both the previous and new balances, offering a clear snapshot of financial standing. The statement meticulously details the transaction history, encompassing all checks processed, withdrawals made, and deposits received during the statement period.

This record allows for thorough reconciliation and financial tracking. Statements for individuals like Donna Baker showcase these details, while balances, such as Osmany Espinal’s $12,460.50, are clearly stated. Reviewing these elements ensures accuracy and helps identify any discrepancies promptly.

Account Summary Details (Previous & New Balances)

Truist bank statements prominently feature an account summary, a crucial section for understanding financial position. This summary distinctly presents the previous balance – the amount carried over from the preceding statement cycle – and the new balance, reflecting all transactions processed during the current period.

This clear delineation allows account holders to quickly assess changes in their funds. For example, statements, like those belonging to Donna Baker, explicitly state these balances. Osmany Espinal’s checking account balance of $12,460.50 on 02/28/2023 exemplifies this detail. This information is fundamental for budgeting, reconciliation, and overall financial management.

Transaction History (Checks, Withdrawals, Deposits)

A Truist bank statement’s core component is its detailed transaction history. This section meticulously lists every financial activity occurring within the statement period. It comprehensively documents checks written, withdrawals (including ATM transactions and debit card purchases), and all deposits made into the account.

Like the statement for Donna Baker, each transaction is typically presented with the date, description, and amount, providing a clear audit trail. This granular detail is essential for identifying discrepancies, monitoring spending habits, and reconciling account activity. Understanding this history is vital for accurate financial record-keeping and fraud detection, ensuring complete transparency of account movements.

Truist Bank Statement Template Availability

While Truist doesn’t officially offer a standardized, downloadable bank statement template for customers to modify, resources are available online. Documents like the “Truist Bank Statement Template ‒ Mbcvirtual (AutoRecovered)” can be found as PDF files, offering a sample layout.

However, it’s crucial to understand these are unofficial examples and may not perfectly mirror current Truist statement formats. Creating a completely accurate replica is difficult, and attempting to forge an official document is illegal. Account holders cannot independently generate official statements; they must be downloaded directly from Truist’s online banking platform.

Personal Financial Statement Information

A Personal Financial Statement, often required for loans or financial assessments, differs from a standard Truist bank statement. While a bank statement details transaction history, a personal financial statement provides a broader overview of an individual’s assets, liabilities, and net worth.

The consent to obtain a consumer credit report is included within this statement. Forms dated 12/2019 and later remain current, unless they reference a heritage institution (like BB&T or SunTrust) before the merger. Truist statements provide crucial data for completing these forms, detailing account balances and transaction activity. Remember to use the most recent statement available for accurate reporting.

Date of Forms and Heritage Institutions

Truist’s Personal Financial Statement forms, specifically those dated 12/2019 or later, are generally considered current and acceptable for financial documentation. However, a critical detail exists: any form explicitly referencing a heritage institution – namely, BB&T or SunTrust – prior to the merger with Truist may be outdated.

This is because account details and branding have evolved since the transition. When utilizing these forms, ensure they reflect current Truist information. Using older forms referencing legacy banks could lead to processing delays or inaccuracies. Always prioritize the most recent version available to ensure compliance and accurate financial representation.

Downloading Statements for Specific Date Ranges

Truist’s online banking platform allows users to efficiently download statements covering precise date ranges. After logging into your account and navigating to the statements section, you’ll be presented with a list of available statements. Instead of selecting a single statement number, the system enables you to choose a specific period.

This feature is particularly useful for tax preparation or detailed financial analysis. Simply select the desired start and end dates, and the system will generate a downloadable statement encompassing that timeframe. Remember to choose the .pdf file format for optimal compatibility and preservation of the document’s integrity. Download the statement to your device once the selection is complete.

Saving Statements as PDF Files

Truist provides a straightforward process for saving your bank statements as universally compatible PDF files. After successfully downloading your statement – whether for a specific date range or a single statement period – ensure you select the .pdf option during the download process. This format preserves the document’s formatting and ensures it can be easily opened on any device.

Alternatively, if you initially view the statement within your online banking portal, you can typically right-click on the statement and choose the “Save as” option. From there, select PDF as the file type. Properly saved PDF statements are ideal for archiving, sharing with financial advisors, or submitting for loan applications.

Can You Create Your Own Bank Statement?

Unfortunately, creating a fabricated bank statement and presenting it as an official financial document is not permissible and carries significant legal and ethical implications; Truist, like all legitimate financial institutions, maintains strict security measures to ensure the authenticity and integrity of its statements.

Attempting to forge a bank statement is considered fraud and can result in severe penalties, including fines and potential criminal charges. Truist statements are specifically designed to be tamper-proof, and any alterations will be readily detectable. If you require official documentation of your account activity, always obtain it directly through your online banking portal or by contacting Truist customer service.

Truist Statement Period Selection

To access your desired statements, begin by logging into your Truist online banking account. Once logged in, navigate to the designated “Statements” section, typically found within the left-hand menu or account overview. From there, you’ll be presented with a list of available statement periods.

Carefully select the specific statement period you require from the provided options. Truist generally offers a comprehensive archive of past statements, allowing you to retrieve records spanning several months or even years. After selecting your desired period, simply click the corresponding download option to save the statement in PDF format directly to your device. This ensures easy access and secure storage of your financial records.

Truist Bank Statement Examples (Osmany Espinal, Donna Baker)

Illustrative examples demonstrate the information contained within Truist bank statements. Osmany Espinal, for instance, held a checking account with a balance of $12,460.50 as of February 28, 2023, as reflected on his statement. Similarly, a statement for Donna Baker provides a detailed account summary, outlining both the previous and new balances.

These statements also meticulously list all transactions occurring during the statement period, including checks written, withdrawals made, and deposits received. This granular level of detail allows account holders to easily track their financial activity and reconcile their records. These examples highlight Truist’s commitment to providing transparent and comprehensive banking information.

Truist Financial Corporation Copyright Information (2023)

All rights reserved by Truist Financial Corporation in the year 2023. The content presented within Truist bank statements, including the format, data, and overall presentation, is protected under copyright laws. Unauthorized reproduction, distribution, or modification of these statements is strictly prohibited without explicit written consent from Truist.

This copyright extends to both physical and digital copies of the statements, encompassing PDF versions and any other formats provided to account holders. Truist maintains exclusive ownership of the intellectual property associated with its banking documentation. Users are granted limited access to view and download their statements for personal financial management purposes only, adhering to the terms and conditions outlined by Truist.

Troubleshooting Statement Download Issues

Experiencing difficulties downloading your Truist bank statements in PDF format? First, ensure you’re logged into online banking and have selected the correct account and statement period. If the download fails, try a different web browser or clear your browser’s cache and cookies. Confirm your PDF viewer is up-to-date.

Persistent issues may indicate a temporary system glitch; wait and try again later. Check your internet connection for stability. If problems continue, contact Truist’s customer support for assistance. They can verify account access and investigate potential technical errors. Remember to right-click the statement and choose “Save as PDF” for proper formatting. Truist provides support to resolve these common download challenges.